Working from Home when Home is in Another Country - The Key Issues

Introduction

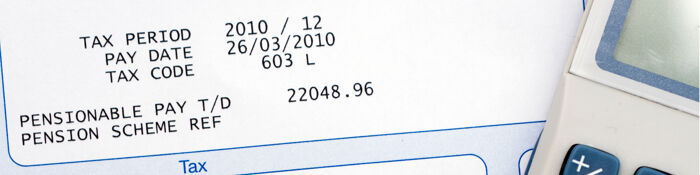

The biggest single phenomenon in business in this decade has been the explosion in working from home (WFH). Suddenly companies realised that employees could work in a wide variety of roles from pretty much anywhere in the world. But what implications are there for the employer if an employee starts to WFH in another country outside of the UK?

The simple answer is ‘plenty’ when it comes to considering the payroll and HR consequences of such a move. Running a payroll in another jurisdiction could prove to be expensive, complex and time consuming.

This webinar will explain all of the key issues you will need to consider and will give you the knowledge to undertake the necessary due diligence of what to do next.

What You Will Learn

This webinar will cover the following:

- Social insurance liabilities and reporting obligations (EEA v rest of world)

- Income tax withholding and reporting obligations

- Non Resident NEDS and UK board meetings

- Permanent establishment risk from WFH arrangements

- Ongoing UK obligations

- Employment law exposure and obligations

This webinar was recorded on 28th June 2023

You can gain access to this webinar and 1,700+ others via the MBL Webinar Subscription. Please email webinarsubscription@mblseminars.com for more details.