Working from Home when Home is Outside of the UK - The Key Issues Explored

Introduction

The world has been figuratively shrinking for some considerable time with the advent of globalisation.

This new full day course will explore the issues for UK based employers where the employee has moved, or wishes to move, from outside of the UK.

It will cover the logistical issues and risks for business including:

- The day to day administrative practicalities

- Visas?

- Will the home workers presence form a permanent establishment of your company in another country?

- Will your liability for employer charges change?

- Will you be prepared to send the employees net pay to an overseas bank account?

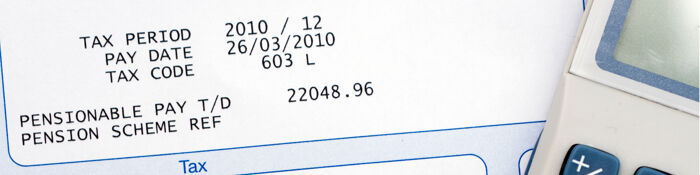

- Will employees remain subject to UK PAYE and remain as a member of your occupational pension arrangements?

This course is aimed at HR and payroll professionals.

What You Will Learn

This course will cover the following:

- Immigration and work permit issues - digital nomads visas

- The risk of forming a ‘permanent establishment’

- Social insurance position within the EU and UK

- The mandatory withholding rules regarding social insurance within the EU

- Social Security Protocol Article 14 options on withholding

- Social insurance position outside of the EU

- Potential UK income tax liability

- HMRC guidance on WFH position

- Income tax withholding in other countries

- Posted Workers Directive

- Employment law obligations - UK and host country

- UK Pension scheme membership - can it continue?

- WFH in the Irish Republic - differences compared to the rest of the EU

- Case study - what to expect when an employee works from home in France