Consumer Debt Recovery & Enforcement - The Latest Law & Practice

Available to view on demand

Added to Basket

Consumer Debt Recovery & Enforcement - The Latest Law & Practice

Introduction

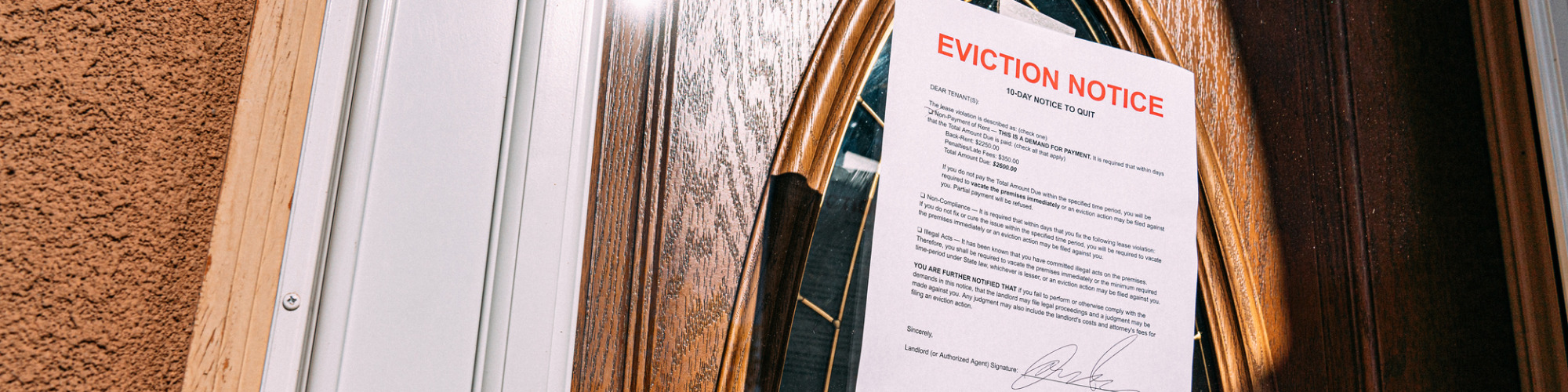

The increase in consumer debt in recent years has been well documented.

For those who supply goods or services to consumers, it has never been more important to ensure that a close watch is kept on outstanding monies, and, where necessary, a clear understanding of recovery options is known.

Legal professionals have an important role to play in this process if acting for and advising creditors and many law firms are recognising the importance of developing key knowledge in this area.

This new webinar is essential viewing for all involved in consumer debt recovery and will ensure you are well equipped to develop expertise in this sector.

What You Will Learn

This webinar will cover the following:

- Can’t pay or won’t pay? - recognising the difference and acting appropriately

- Pre-Action enquiries and checks - what can you find out and how useful is the information?

- The Pre-Action Debt Protocol - a debtor’s charter or a fair balance between debtor and creditor?

- Taking legal proceedings for consumer debt recovery - tips and tactics to ensure you get the claim right and maximise monies owed

- Enforcing the judgment - what are the options?

- Temporary limits on the recovery process through the pandemic - how much tougher is it?

- Insolvency procedures in consumer debt recovery - including the new breathing space regime

This webinar was recorded on 15th September 2021